According to 2023 report by the International Monetary Fund (IMF), Tajikistan’s ‘fiscal space remains limited due to debt sustainability concerns’ and Rogun investment has been a major problem for country’s fiscal health, while both the project costs and delays are on increase. ‘Finding a solution to the construction of Rogun that does not crowd out government spending on health, education, social welfare and other infrastructure must be one of the government’s top priorities,’ reads the 2022 World Bank’s own report Public Expenditure Review of Tajikistan. However, when political decision to support Rogun became ripe the IMF and the World Bank made an unprecedented U-turn and now they preach that taking on multi-billion non-concessional loans is perfectly safe for Tajikistan.

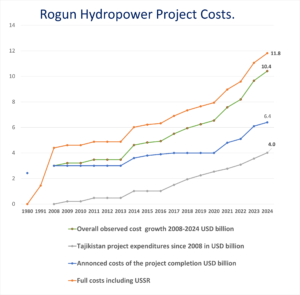

Graph: The costs of Rogun HPP Project have increased dramatically over time and the speed of this increase has accelerated lately (Figures derived from official documents of the IMF, World Bank and Tajikistan Government).

The International Monetary Fund (IMF), the institution in charge of macroeconomic and financial stability, approved a non-financing arrangement with the Government of Tajikistan in 2024. As stated in the Staff report for the PCI’s request, the arrangement has at its center ensuring macroeconomic and financial stability as the country undergoes the building of the Rogun dam given it ‘could help catalyze financing for the Rogun HPP, a key priority under the authorities’ development strategy’.

The Rogun dam would be the tallest hydropower dam in the world and has been eroding the country’s fiscal position with ever-increasing costs, while creating irreversible social, economic and ecological damage. Given the fact that the IMF is not the institution to decide whether to pursue the project or not, but has macroeconomic and financial stability as its mandate, there are serious concerns regarding the way the arrangement was done.

The IMF’s scenarios around increased costs in the building of the project are extremely conservative. The costs of the project have more than tripled according to what was estimated in 2008. The unexpectedly higher capital spending in the second half of H2 2023 related to Rogun has increased the fiscal deficit of Tajikistan by 1% of GDP only last year. The increased volatility in global monetary policy has led to higher borrowing costs, and there’s no evidence this will subside in the near future.

Besides, the project threatens more than 50 thousand people with resettlement which can highly likely not be done according to international standards given the government’s track record with human rights and lack of finance devoted to social needs.

The IMF underestimates risks entailed by the government’s financing package. The country’s commodity dependence and the financing profile of the Rogun dam lock it in extremely high vulnerability to external shocks. The PCI proposes domestic resource mobilization, fiscal discipline, and cost recovery for electricity tariffs as a way forward in mitigating risks to Balance of Payments (BOP) stability. However, it is unclear what the contingency scenarios are, whether impact assessments have been undertaken, what the impacts of increases in electricity tariffs, expanding regressive DRM and of the re-prioritisation of capital expenditures (delaying Tajikistan’s SDGs) are. The World Bank in its July 2024 report on Tajikistan’s economy concludes that the rapid increase in the inflation rate is likely due to the 16% rise of electricity tariffs.

The IMF does not provide enough evidence to approve the exception to the Debt Limits Policy. The Operational Guidance Note on the Debt Limits Policy clearly states that projects must have clear social and economic returns for them to be included under the exception of the DLP. While it is unclear whether in the near future the project, which is planned to become fully operational only by 2040, will lead to higher access to electricity to the country’s population, already among the poorest in the world and highly likely needing to pay more costly tariffs to finance the project.

This arrangement reveals the limitations of the Fund’s climate expertise and how problematic this can be. The Staff report states that ‘Rogun HPP project has been designed by taking extreme climate change events into account’. Meanwhile, the key reason for the current climatic vulnerability of Tajikistan is its over-reliance on hydropower, which generates more than 90% of its electricity. Therefore adding the giant Rougun dam will prolong for a decade regular electricity blackouts and only exacerbate the problem. To reduce climate vulnerability one must invest into diversification of energy sources.

According to analysis by 14 local and international NGOs, the ESIA fails to calculate the costs of avoiding or mitigating major negative impacts, including the reduction of the river flow to the Aral Sea, impacts on the “Tugay Forests of the Tigrovaya Balka” World Heritage site in the Vakhsh River floodplain, degradation of the habitat of critically endangered endemic sturgeons, or the diverse and problematic consequences of resettling 50.000 people.

Related reading:

CSO Letter to IMF , October 2024

Rogun dam budget spiral to make authorities sweat. 2024

Tajikistan’s Rogun hydropower project cost rises to $6.4bn, completion targeted by 2035. 22 August 2024

Tajikistan Economic Update: Focusing on the Footprint of State-Owned Enterprises and Competitive Neutrality World Bank. 11 July 2024

Eurasian Development Fund: Funding for Rogun HPP Jeopardizes Other Projects . 11 July 2024

World Bank report voices concern about influence of state-connected companies on economy. 24 July 2024

The Rogun Dam Trap. 2018